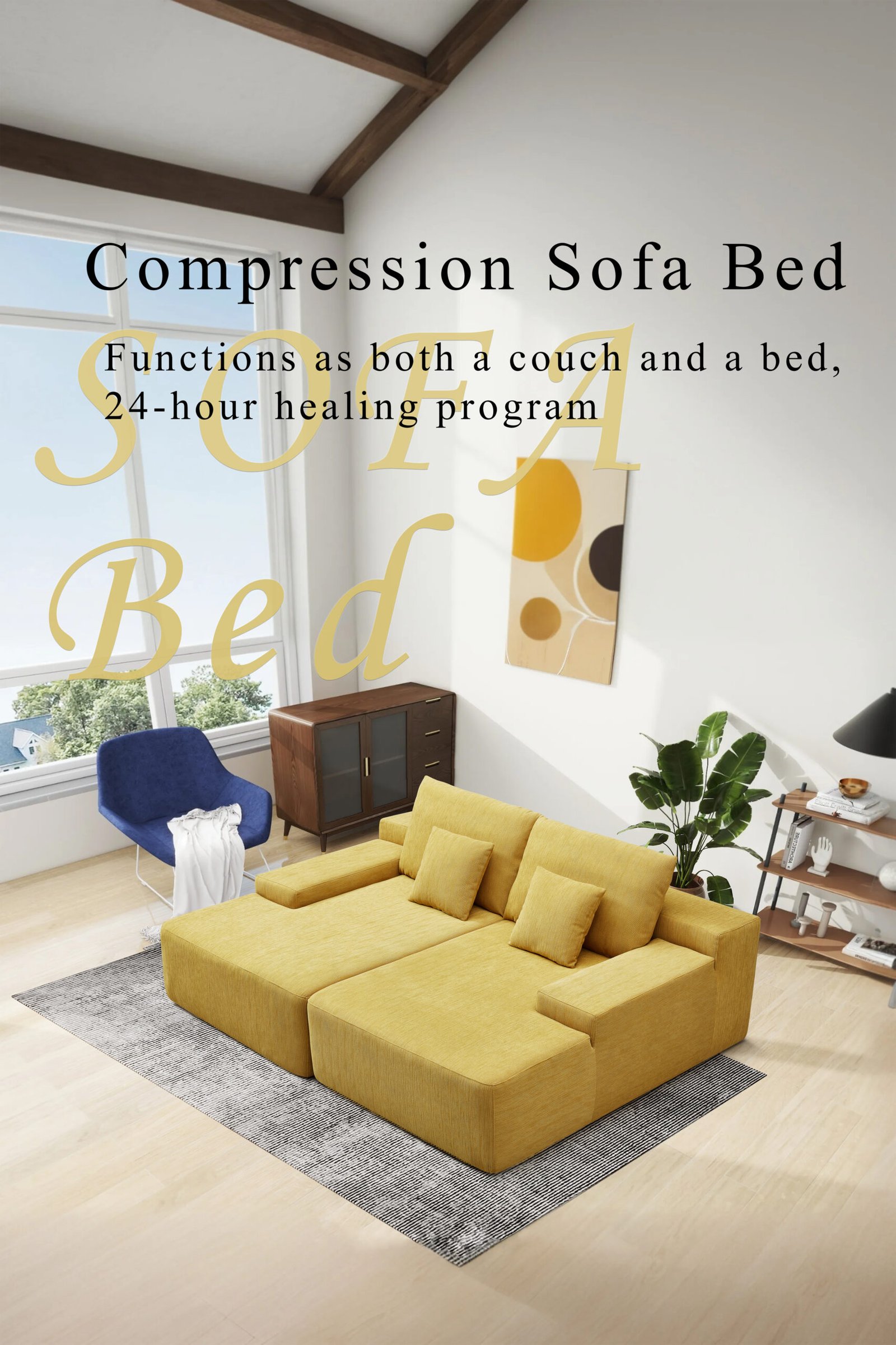

Shipping bulky furniture across the globe is expensive and inefficient. But compressed sofa suppliers are rewriting the rules of global trade.

Compressed sofa suppliers are transforming international furniture logistics by reducing volume, lowering costs, and opening new trade opportunities in previously unreachable markets.

In this article, I’ll explore how this innovation reshaped my supply chain, helped break into overseas markets, and leveled the playing field for smaller furniture exporters.

Why are compressed sofa suppliers gaining global traction?

Traditional sofas are hard to ship. They eat up container space, inflate freight costs, and are tough to handle at ports.

Compressed sofas, which are vacuum-packed or flat-packed, reduce size by up to 70%—making international shipping far more efficient.

Global furniture buyers—especially in North America and Europe—are demanding:

- Fast delivery

- Smaller MOQ for test orders

- Lower landed costs

- Compact, DIY-friendly products

And compressed sofas tick every box. That’s why international demand for compressed seating has exploded over the last 5 years.

How has international shipping changed?

Container space is gold. The pandemic taught us that. Suppliers who can ship more units per CBM (cubic meter) dominate the game.

Compressed sofas let exporters double or triple their container loading capacity—cutting per-unit freight costs drastically.

Example Comparison:

| Sofa Type | Units/40HQ | Avg. Freight Cost/Unit |

|---|---|---|

| Traditional Sofa | 150–180 | $50–70 |

| Compressed Sofa | 350–400 | $20–30 |

When I switched to compressed exports, my cost per unit dropped by 45%. That savings made it easier to win overseas buyers on platforms like Alibaba and Amazon Global Selling.

Which countries are leading the trade?

The rise of compressed sofas has reshaped which countries lead the export game.

China, Vietnam, and Poland dominate production—thanks to mature manufacturing ecosystems and scalable supply chains.

Leading Exporters of Compressed Sofas:

| Country | Strengths |

|---|---|

| China | Advanced compression tech, OEM/ODM capacity, Alibaba ecosystem |

| Vietnam | Labor cost advantages, rising mid-market focus |

| Poland | Access to EU market, strong wood-processing base |

I manufacture in China, but I’ve seen partners in Vietnam win European buyers by offering compressed models that save on intra-EU logistics.

What makes compressed sofa suppliers more competitive?

Whether you're a small brand or a large chain, logistics eats your margins. Compressed sofas flip that dynamic.

Suppliers offering compressed models can compete on landed cost, delivery speed, and inventory flexibility.

Competitive Advantages:

- Lower shipping costs → better retail price

- Smaller SKUs → easier warehousing

- DIY setup → faster customer fulfillment

- Stackable cartons → fewer damages in transit

These are hard numbers buyers care about. And they shift the power from legacy sofa brands to agile, compressed-focused suppliers.

How are B2B buyers sourcing differently?

Traditional buyers worked with freight forwarders, managed large MOQ, and absorbed big risks.

Today’s buyers want FOB-ready compressed sofas with flexible MOQ, branded cartons, and door-to-door support.

What my international clients now ask for:

- Compressible SKUs with assembly guides

- MOQ as low as 20 sets for first order

- Mixed-container support (3–5 styles per FCL)

- Drop shipping or DDP terms

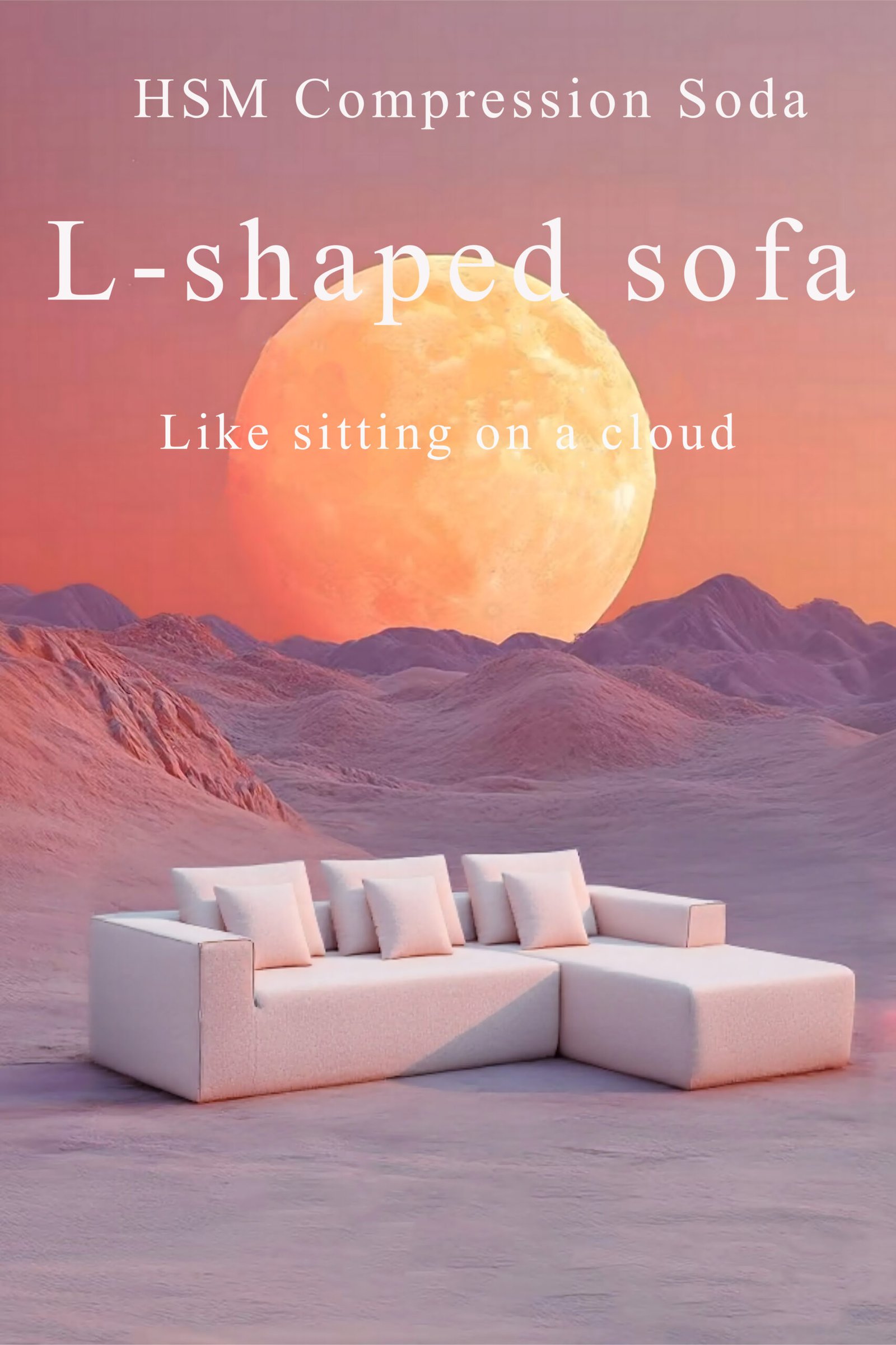

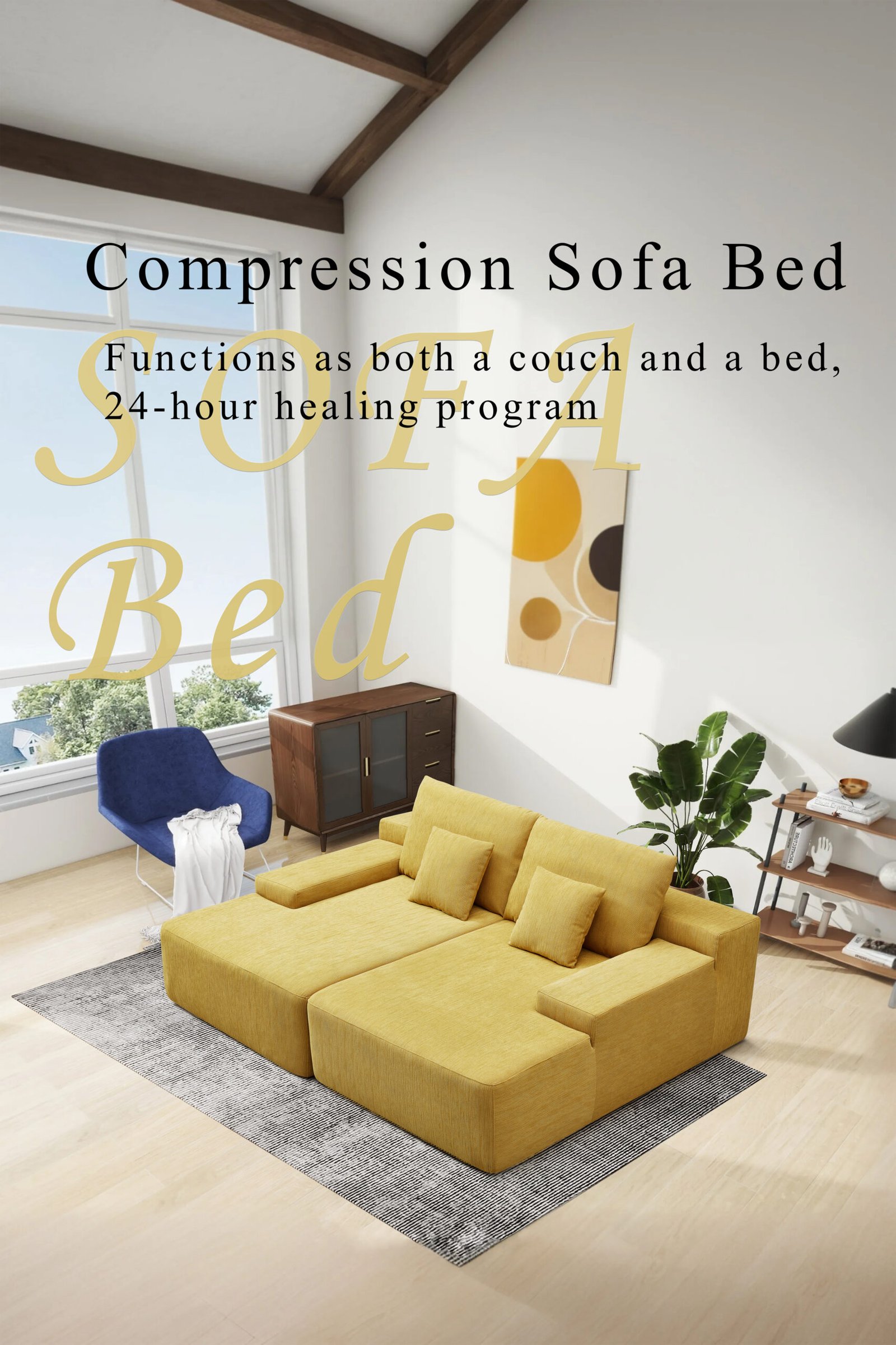

This is why HSM developed a sofa-in-box line specifically for global B2B accounts on Amazon and TikTok Shop Europe.

What role does e-commerce play?

You can’t ship a full-size sofa through DHL. But you can with a compressed one.

Compressed sofas enable e-commerce platforms like Amazon, Shopify, and TikTok to sell seating globally—without a warehouse.

That’s why our compressed sofas are:

- FBA and FBM compliant

- Packaged under 50kg for courier delivery

- Delivered in 2–5 days with local partners

This shift allows even small factories to serve international dropshippers and build direct-to-consumer (DTC) brands overseas.

What are the trade challenges?

Compressed sofas aren’t magic. You still face barriers—especially when scaling overseas.

Common Challenges:

- Product Certification: e.g., CA TB117, EN12520 fire resistance

- Unboxing Experience: if quality is poor, complaints skyrocket

- Damage in Transit: low-quality packaging ruins decompression

- IP Protection: design theft is real on global B2B platforms

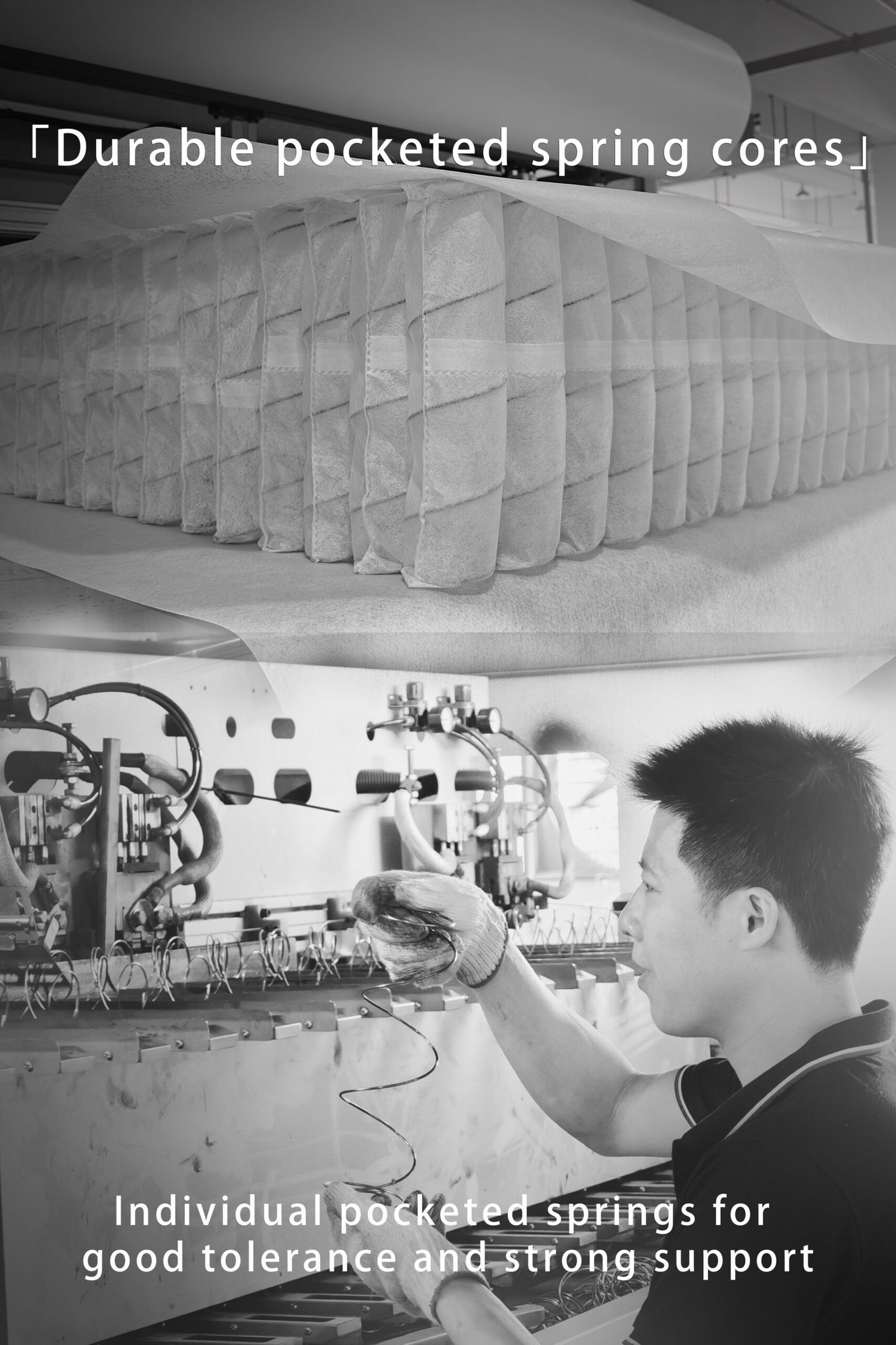

We addressed this by investing in reinforced packaging, offering branded QR setup videos, and filing patents on 200+ frame designs.

What’s the future of compressed sofa trade?

Global buyers want faster delivery, smaller orders, and more customization. Compression makes that possible.

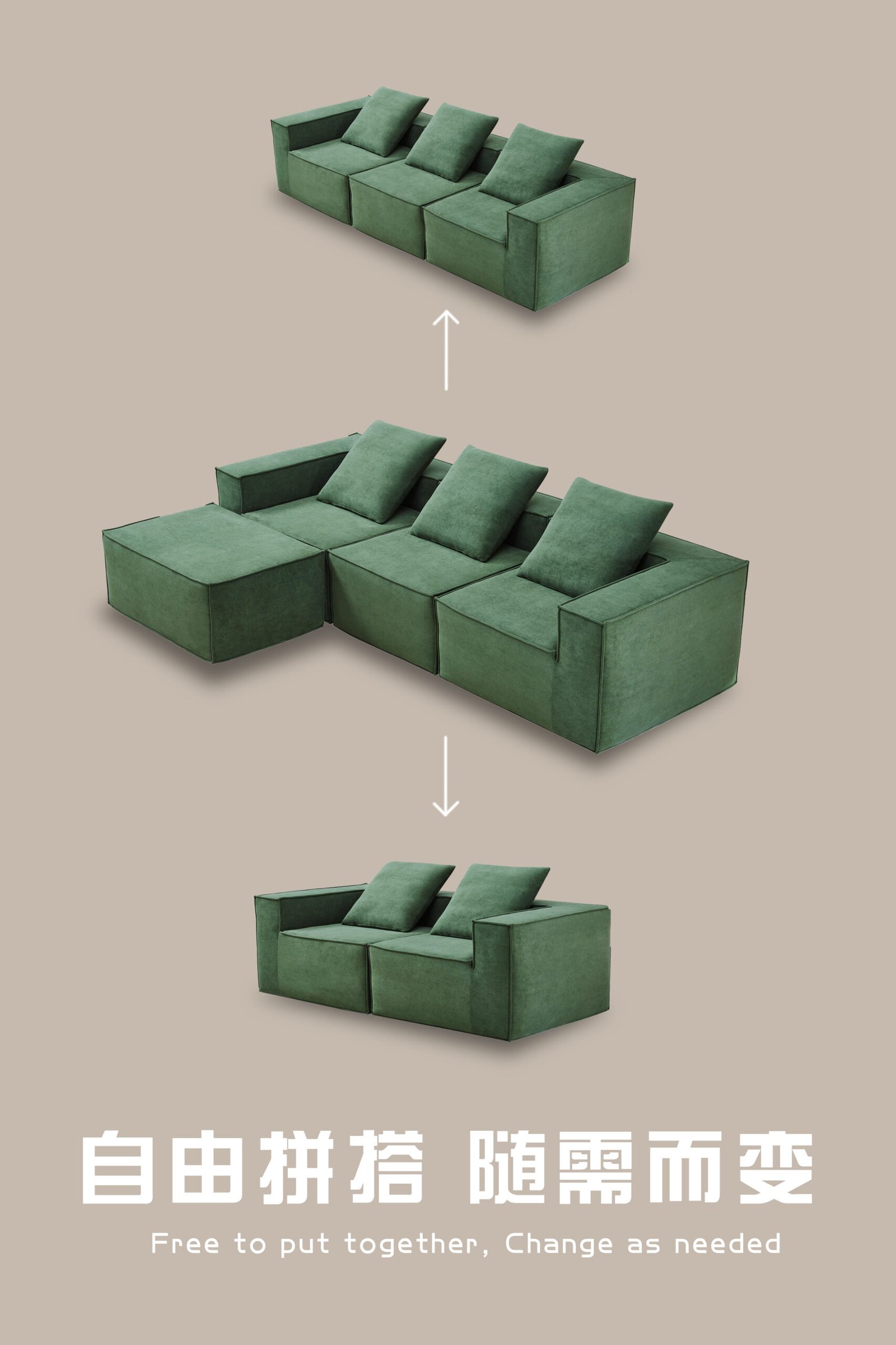

The future lies in modularity, automation, and carbon-friendly logistics—led by flexible, tech-driven suppliers.

Coming soon:

- AI-optimized box layouts for faster container loading

- Carbon-tracked shipping invoices

- Smart fabric tracking for circular reuse

- RFID-labeled sofa parts for reverse logistics

Suppliers that invest now will dominate trade routes for the next decade.

Conclusion

Compressed sofa suppliers are redefining global furniture trade—one box at a time.